Are you a first-time homeowner who is confused about all the jargon and complex acronyms (e.g. Mortgage Servicing Ratio – MSR) you come across while researching about mortgage loans?

Not to fear! We are here to help simplify all these complex terminology for you!

Taking a bank loan for your new BTO or Executive Condominium (EC)? These are two terms you absolutely need to understand before going ahead with your loans – Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR).

What is Total Debt Servicing Ratio (TDSR)?

The Total Debt Servicing Ratio (TDSR) is essentially a loan threshold set by MAS.

MAS being the government body that looks out for all our money concerns, wants to make sure that no one spends too much of their income on debt. This means all kind of debt – from property, car, school, or credit card loans.

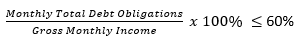

According to prevailing MAS policy, TDSR cannot exceed 60% of gross monthly income.

What does it mean for your property purchase?

If your monthly gross income is $5000, your total monthly debt obligations must be less than:

60% x $5000 = $3000

If you do not have other debt obligations, then your limit is the full $3000.

If you have other debt obligations, for example $1000 that you pay for your car, then your limit is now $3000 – $1000 =$2000.

What is Mortgage Servicing Ratio (MSR)?

Closely linked to the TDSR, the Mortgage Servicing Ratio is a property specific loan threshold set by MAS.

Because property mortgage loans tend to be one of the largest types of loans anyone could possibly incur, MAS decided to create a specific threshold for this. To prevent people from overspending on property they cannot afford.

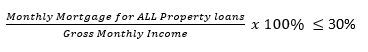

According to prevailing MAS policy, MSR cannot exceed 30% of borrower’s gross monthly income

This is only relevant if your housing loan is for HDB flat or EC. If you are buying a private property, you will only be limited by the TDSR.

What does it mean for your property purchase?

If your monthly gross income is $5000, your total monthly debt obligations towards your property mortgage must be less than:

30% x $5000 = $1500

This means that when you take a bank loan for your new BTO or EC, you need to make sure your monthly repayments is below $1500. Else your loan will not go through.

How to calculate TDSR and MSR?

Wondering what is the loan limit you and your partner will be subjected to? You can do a quick calculation based on the formula below.

TDSR

Considerations:

- Monthly debt obligations to include property, car, student, renovation, credit card or other loans

- Debt obligations to use the appropriate interest rates as proposed by MAS

- Gross monthly income is income before tax excluding any CPF contribution

- 100% of monthly fixed income

- 70% of monthly variable income

- 70% – 100% Liquid assets or other financial assets (pledged for at least 4 years)

MSR

Considerations:

- Include all property loans

- Include ≥ 20% of the monthly debt obligation for property loan where the borrower is a guarantor.

Hopefully after reading this article has you equipped you with the basic knowledge to help you have that productive mortgage discussion with your financial institution on your loan.