If you think that your property’s selling price is the only thing you’ll pay, you’re sorely mistaken. Apart from that, there are other “hidden” costs that won’t be displayed outright when you make your purchase.

Read on to know what these costs are!

Ownership Fees

Legal fees, option fee, option exercise fee, stamp duty, valuation fee, stamp duty for mortgage agreement fees – these are some, or all the costs you have to pay when you purchase your property.

Option fees are used to secure your place that you want to get. This is applicable to both HDB flats and private property. Think of it as paying a sum to “chop” it. It’s usually 1% of the agreed property purchase price.

For the option exercise fee, it’s usually 5 to 10% of the purchase price, applicable to private home buyers. Home buyers also must pay stamp duties, which is currently at 1% for the first S$180,000, 2% for the next and 3% for the rest. Mortgage agreement fees cost about 0.4% of the agreed price.

For both HDB and private properties, you need to pay legal fees to a lawyer for completing background checks and any transfer of ownership title. The prevailing amount for private properties is about 0.4% for this, for a maximum of S$3,000. For HDB flats, the amount depends.

Interest Cost

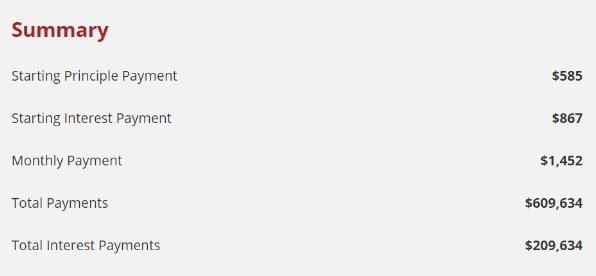

If you’re getting a home loan, be it from the HDB or the bank, you’ll have to pay interest. Think about it – if you’re getting a $400,000 loan with 2.6% interest over 35 years, that will be S$209,634 out the window. You can calculate yours here to have an idea of how much yours will cost!

Renovation Cost

Always wanted that gorgeous, palatial-type design for your home? Love your carpentry? A glamourous walk-in wardrobe to store your Hermes and Chanel bags, the epitome of every woman’s (home) material lust? Marble flooring?

All of these don’t cost a pretty penny. Be prepared to fork out at least S$20,000 to S$100,000 on your home renovation, especially if you’re thinking of having lots of carpentry. Let’s not even begin to think about how much furniture costs – this is heavy enough.

Opportunity Cost

Whatever you do, you’re going to incur opportunity costs. Perhaps that S$500,000 you used to purchase your home could have netted you a windfall in investments, or yielded hefty interest.

Of course, if you treat your property as an investment, that’s pretty neat too – provided that you do your own calculations and research for the future, of course.

Maintenance and Conservancy Fees

Whether you’re getting private property or a HDB, you have to pay maintenance or conservancy fees. These aren’t fees for maintaining your house, but the area around it.

Yes, we know horror stories of ruthless vandals writing expletives over freshly painted walls, or foreign nationals using the condominium facility as their private washing machine, but irregardless, you still need to pay up.