Just popped the question, “Want to BTO?” to your significant other? Congratulations to both of you! Now, are you scouring the Internet on what to do next? If you are new to this, buying a BTO from HDB may seem like a scary process – so many terms you have never seen before (HDB Loan Eligibility Letter, Agreement for Lease and more…).

Not to fear, we have helped compile a simple to understand checklist for new homeowners like you! Read on to start your process today!

Step 1: Check for Eligibility

This is the first and most necessary step – make sure both you and your partner are eligible to purchase a BTO together.

Eligibility conditions to purchase an HDB BTO include:

- At least 1 Singapore Citizen applicant or At least 1 other Singapore Citizen or Singapore Permanent Resident#

- At least 21 years old

- Your combined income is within the set income ceiling for the flat you intend to buy

- You do not own other property overseas or locally, and have not disposed of any within the last 30 months

- You cannot invest in private residential property from the date of flat application till after the 5-year Minimum Occupation Period (MOP)

- You have not bought a new HDB/ DBSS flat or EC, or received a CPF Housing Grant before or

- You have only bought 1 of those properties/ received 1 CPF Housing Grant before

To double confirm, simply complete this simple 5-minute official HDB Eligibility check.

Step 2: Check Your Finances

When buying anything, especially when it comes to a huge purchase like a BTO, you will need to make sure you have enough money to cover the cost.

Do thorough research, and check your finances:

- Determine your combined cash and CPF savings

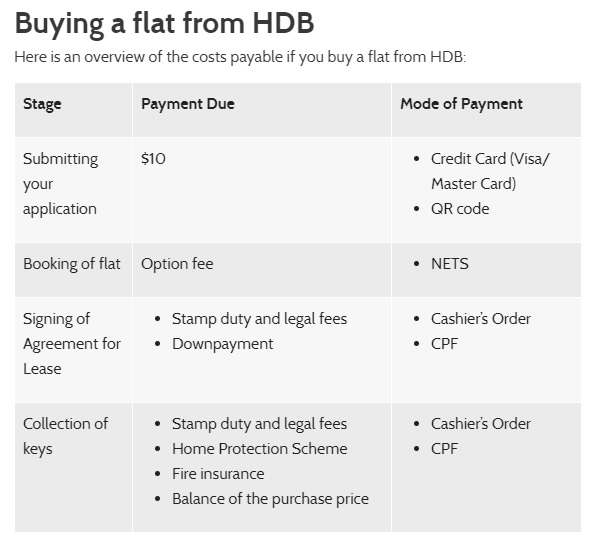

- Understand payments and fees associated with a new BTO purchase

- Calculate your future mortgage (housing loan payments) commitments

- Compare housing loans from HDB vs. banks

- If you’re getting a housing loan from HDB, you will need a HDB Loan Eligibility (HLE) Letter (apply here)

- If you’re getting the loan from banks, you need apply as early as possible to get a Letter of Offer (before you can proceed with the Agreement of Lease for BTO).

Sounds daunting? Not to worry, HDB has a useful Financial Plan e-Service that can help you determine estimated figures of payments and when they are due. Simply provide details of your CPF, income and HLE letter, to get a clear overview specific to your situation.

Step 3: Check for New Launches and Apply

Keep an eye out for new BTO launches – they are regularly updated on HDB’s site or sign up for their free eAlert Service!

Once the launch has been announced, you have 1 week to submit your applications online ($10) – also known commonly as balloting.

Step 4: Result of Your Application

Typically for BTOs, the outcome of the ballot will be announced 1.25 months after the application period closes.

If successful, you will be invited to select a flat in your chosen estate based on your ballot queue number.

Step 5: Book Your Flat

If you are lucky enough to select a flat you want, you will need to put down a “option fee” – it is a deposit of sorts ranging from $500 to $2,000. You will need a valid HLE letter at this stage.

Step 6: Agreement for Lease

Since the BTOs will still be under construction, you will need to sign an agreement for lease. This will be the big confirmation – with the significant down payment, stamp duty and legal fees to be paid. You can pay in cash or CPF.

Step 7: Wait to Collect Keys

HDB will update you on when you can head down to collect your keys when the construction is complete. And viola, there you have it – your new home.